The Role of Funding and Policies on Innovation in Cancer Drug Development

ACKNOWLEDGEMENT

This report was funded by an unrestricted educational grant from Novartis Pharma AG.

THE ROLE OF FUNDING AND POLICIES ON INNOVATION IN CANCER DRUG DEVELOPMENT

Results: Funding, Bibliometric Outputs and Faculty Survey

Policy Implications: Funding, Bibliometric Outputs and Faculty Survey

National and supranational roles in innovation

The uniqueness of rare cancers

Role of the reimbursement system

Continuous evaluation of oncology drugs

Optimising resource allocation in health care

1.1.1 Risk Factors, Incidence and Mortality

1.1.2 Prevalence and Direct/ Indirect Costs

1.1.3 Advancement in Cancer Medical Treatments

1.3. Trends in R&D spending and output by the private sector

1.3.1 Aggregate R&D trends in pharmaceutical and biotechnology industries

2. THE HISTORY AND SCIENCE OF CANCER DRUG DEVELOPMENT

2.1. A European History of Cancer Research

2.2. New Paradigms in Chemotherapy

2.4. Biologicals for Cancer Therapy

3. PUBLIC AND PRIVATE FUNDING FOR CANCER DRUG RESEARCH AND DEVELOPMENT

3.1. Background and objectives

3.2.1. Surveying public sector spending on cancer drug research and development

3.2.2. Private sector contribution

3.3.1. Public (non-commercial) funding

3.3.2. Private sector cancer funding organisations

3.3.3. Public-Private partnerships in cancer drug development

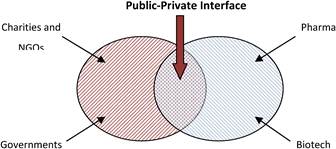

3.4.3. PPPs in cancer drug development

4. RESEARCH ACTIVITY IN DRUG DEVELOPMENT: A BIBLIOMETRIC ANALYSIS

4.1. Background and Objectives

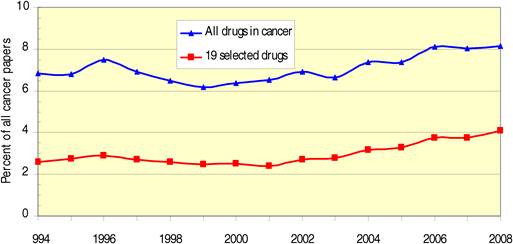

4.2.3. Comparison with outputs of all cancer research and all drugs

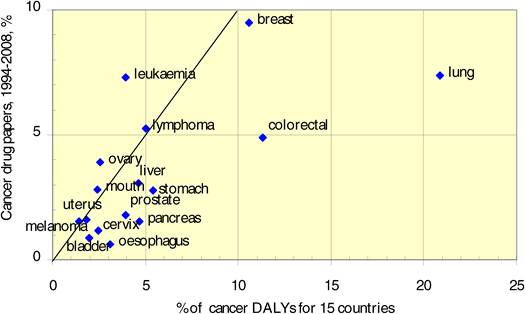

4.2.6. Cancer Manifestations and Disease Burden

4.2.7. Funding of Cancer Drug Research

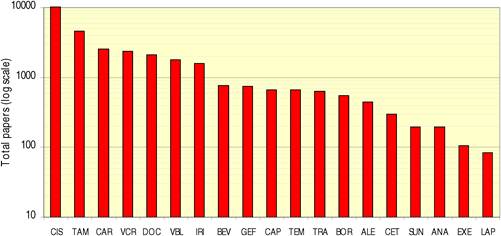

4.3.1. Volume of cancer drug paper outputs

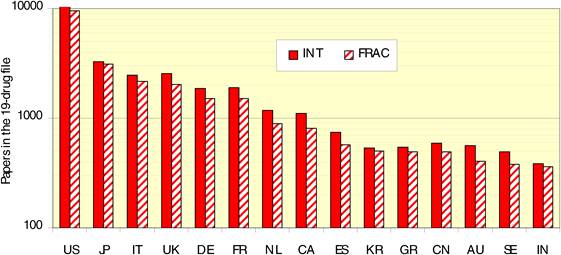

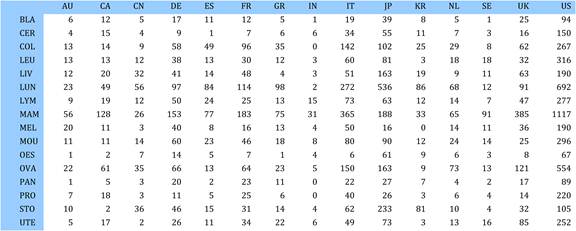

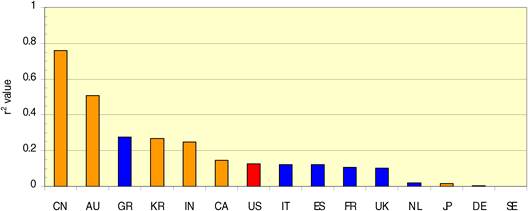

4.3.2. National involvement in cancer drug research

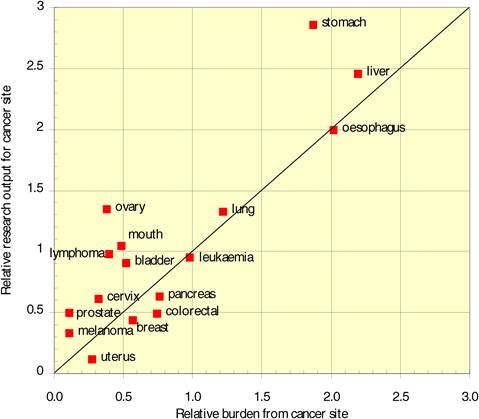

4.3.3. Site specific research in cancer drug research

4.3.4. Clinical versus basic cancer research types

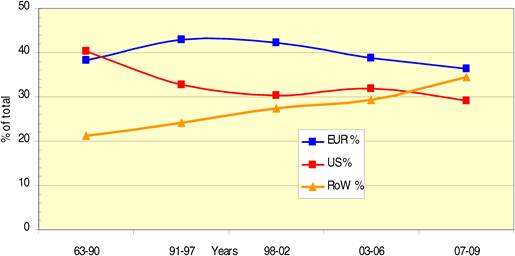

4.3.5. Trends in global and regional cancer drug development

4.3.6. Funding of cancer drug research

4.4. Conclusions and Policy Issues

5. PROMOTING AND SUPPORTING CANCER DRUG R&D-RESULTS OF A SENIOR SCIENTISTS SURVEY

5.1. Background and Objectives

5.2.1. Semi-Structured Interviews

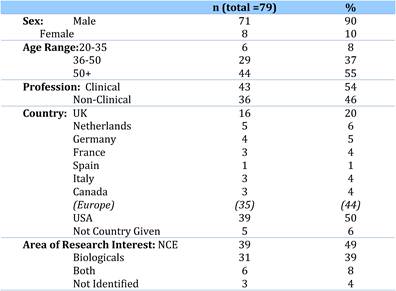

5.2.2. Faculty: Inclusion Criteria and Demographics

5.2.3. Questionnaire Development

5.3. Results of the clinician and scientist survey

5.3.1. Interviews with drug development faculty

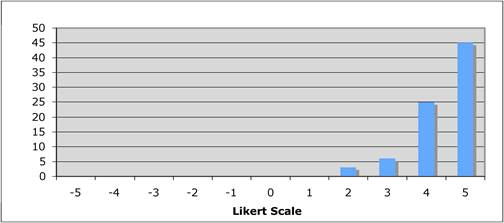

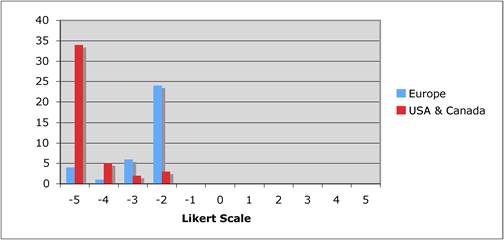

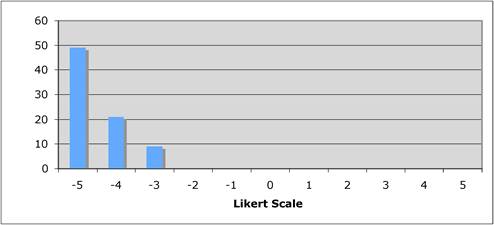

5.3.2. Results of the survey of European and USA key opinion leaders

5.4. Discussion and policy implications

5.4.1. Public-Private Partnership Models

5.4.2. Investing in Cancer Drug Development

5.4.3. Environment for cancer drug development

6. SUPPORTING AND ENABLING INNOVATION IN ONCOLOGY: ISSUES IN PUBLIC POLICY

6.1. Background and Objectives

6.3. Contribution of pharmaceutical innovation to health and well being

6.3.2. Impact of pharmaceutical innovation on health

6.4. Is health care and pharmaceutical innovation worthwhile?

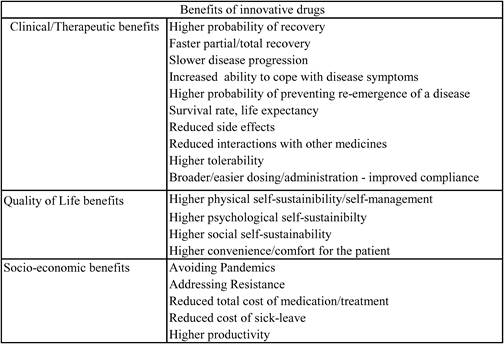

6.4.1. Therapeutic/clinical benefits

6.4.2. Socio-economic benefits

6.5. Different approaches to valuing pharmaceutical innovation in Europe

6.5.1. Valuing innovation in the context of drug reimbursement

6.5.2. Rate of return regulation

6.5.3. Assessment of clinical/therapeutic benefit

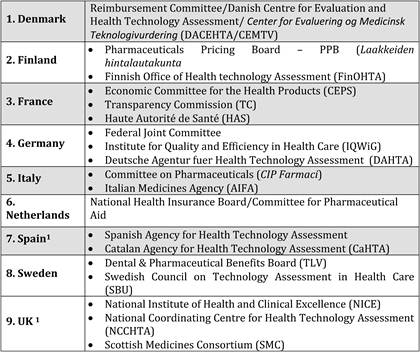

6.5.4. Health Technology Assessment in assessing value of innovation

6.5.5. Role of European institutions

6.6. Fostering innovation in oncology: A list of priorities

6.6.1. The role of national and supra-national science, research and innovation policy

6.6.2. Need for pricing and reimbursement systems to reward and encourage innovation

6.6.3. Continuous evaluation of oncology drugs

6.6.4. Encouraging long-term innovation

6.6.5. Optimising resource allocation in health care

7. CONCLUSIONS AND POLICY IMPLICATIONS

7.2.1 Results of public and private research funding organisations survey

7.3 Capturing investment in oncology through research outputs

7.3.1. Results of the bibliometric survey on oncology research output

7.4 Public Policy in Oncology Development

7.4.1. Results of our public policy survey of oncology clinicians

7.5. Fostering innovation in oncology: A list of priorities

7.5.1. The role of national and supra-national science, research and innovation policy

7.5.2. Encouraging and rewarding innovation through the reimbursement system

7.5.4. Minimising (negative) externalities

7.5.5. Continuous evaluation of oncology drugs

7.5.6. Optimising resource allocation in health care

List of Tables and Figures

1. Background and Objectives

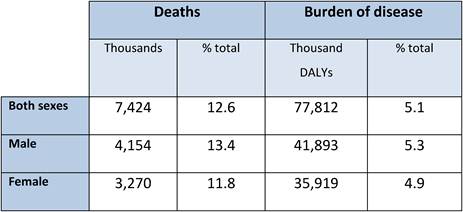

Table 1.1 Global cancer related deaths and burden of disease by sex (2004)

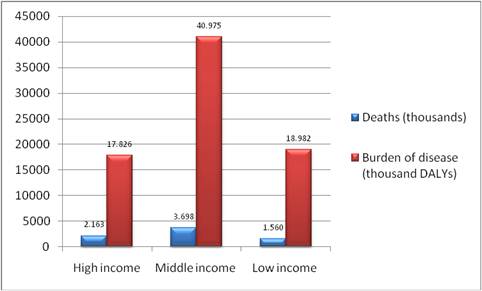

Figure 1.1 Cancer related deaths and burden of disease grouped by income per capita (2004)

Source: World Health Organisation, The Global Burden of Disease: 2004 update. WHO 200.

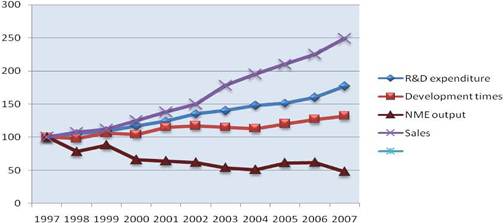

Notes: Each trend line has been indexed to 1997 values

Development time data point for 2007 includes data from 2006 and 2007 only

Source: CMR International & IMS Health

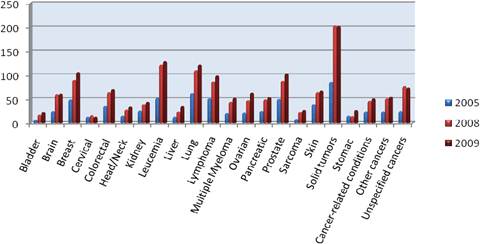

Figure 1.3 Number* of new cancer drugs in development by type of cancer

Figure 3.1 The public-private interface in cancer drug research and development

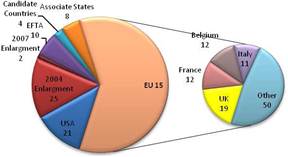

Figure 3.2 Number of public sector funding organisations by country

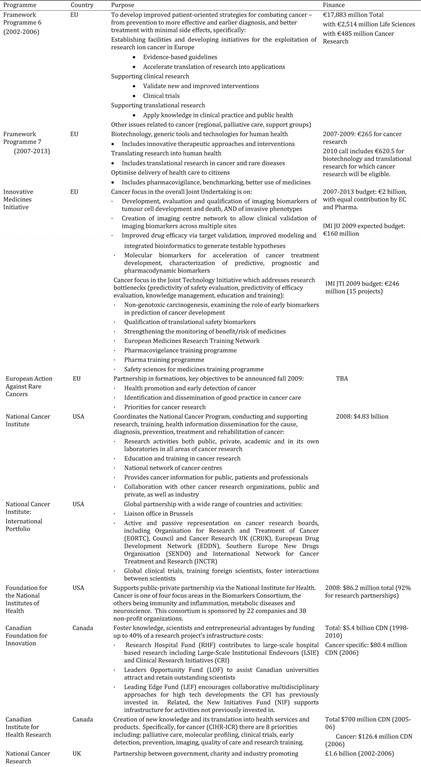

Table 3.1 Synopsis of policies and programmes encouraging cancer drug development globally

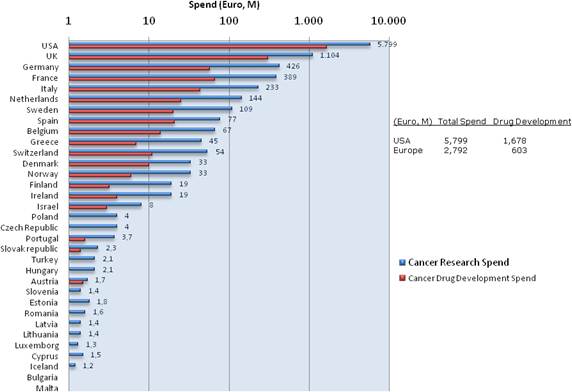

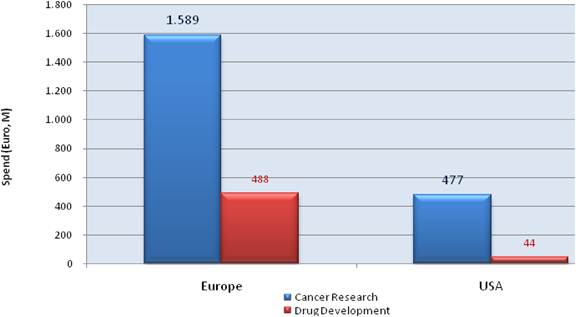

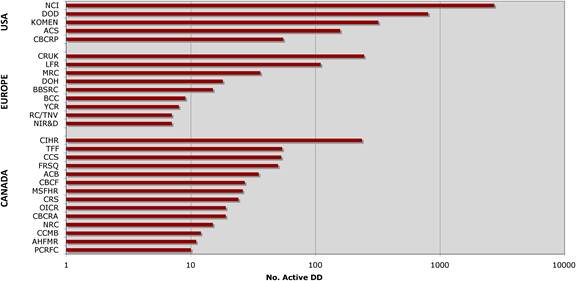

Figure 3.3 Direct cancer drug R&D (Spending on log scale)

Table 3.2 Drug R&D as percentage of total direct spending

Figure 3.4 Estimated indirect cancer R&D funding

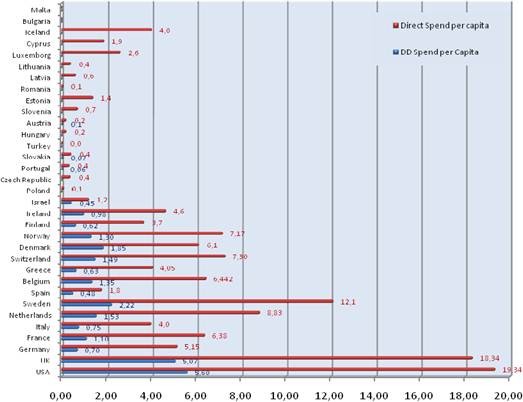

Figure 3.5 Cancer R&D direct spending (€) per capita

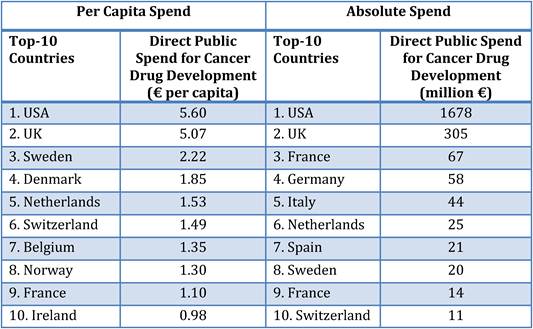

Table 3.3 Top-10 public spenders on cancer R&D per capita vs. absolute spending

Table 3.4 Top-10 public spenders on cancer drug R&D per capita vs. absolute spend

Table 3.5 Main funding sources of Europe's top funding countries (public sector)

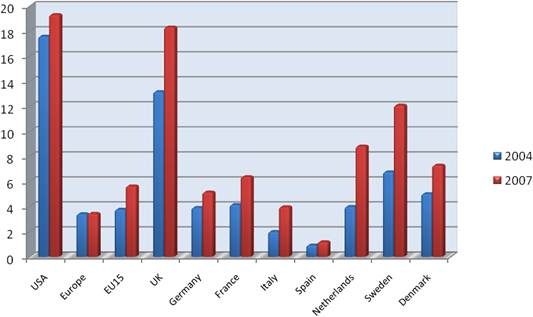

Figure 3.6 Direct cancer R&D spending per capita, 2004 vs. 2007 (€)

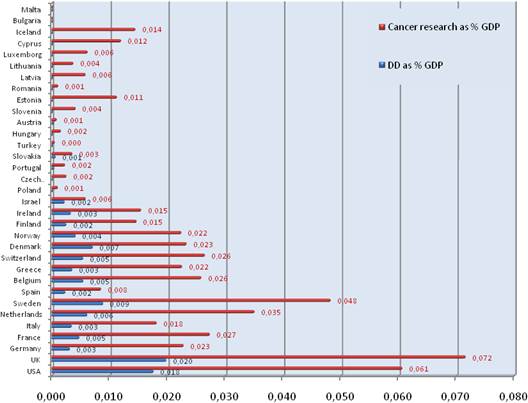

Figure 3.7 Cancer drug R&D and cancer R&D direct spending, % of GDP

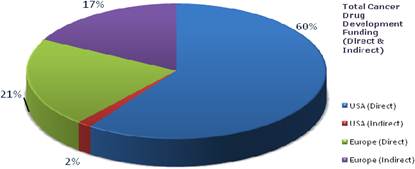

Figure 3.8 Route of cancer drug R&D funding

Figure 3.9 Cancer drug R&D spend per capita (€)

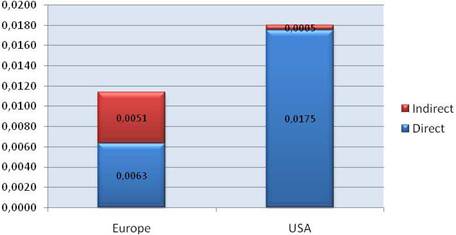

Figure 3.10 Cancer drug R&D spend, % of GDP

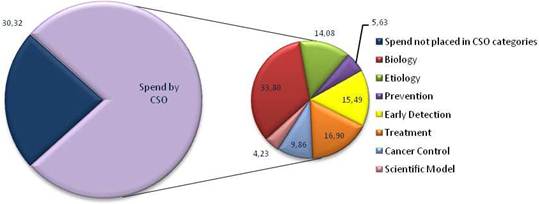

Figure 3.11 European cancer R&D spend by CSO category

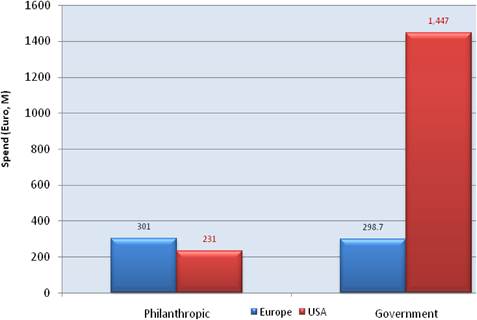

Figure 3.14 Drug R&D funding by charities and government (2007)

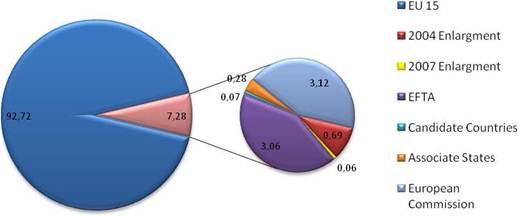

Figure 3.15 Percent of direct spend by political group in Europe (2007)

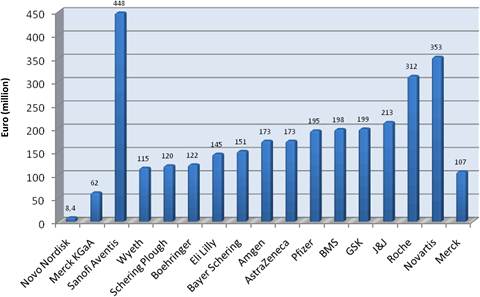

Figure 3.16 Private cancer drug development spend: major pharmaceutical companies (2004/ Phase III)*

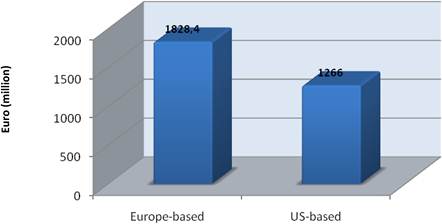

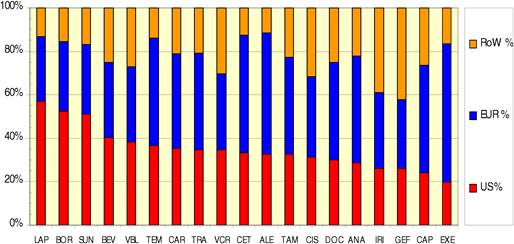

Figure 3.17 Private cancer R&D funding by company origin

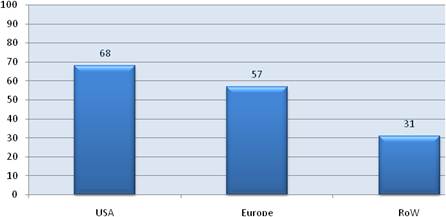

Figure 3.18 Cancer drug development projects with joint private-public funding (%) (2007-8)

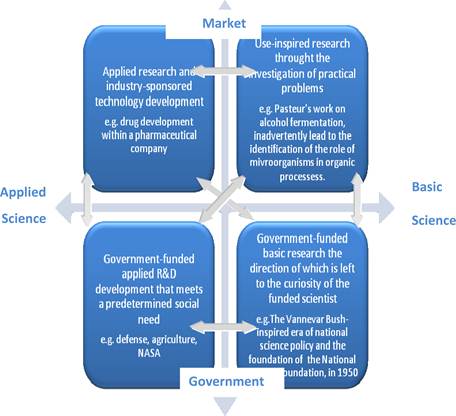

Figure 3.19 Interaction between basic vs applied science and between market vs government

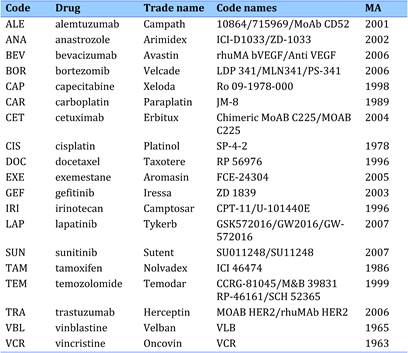

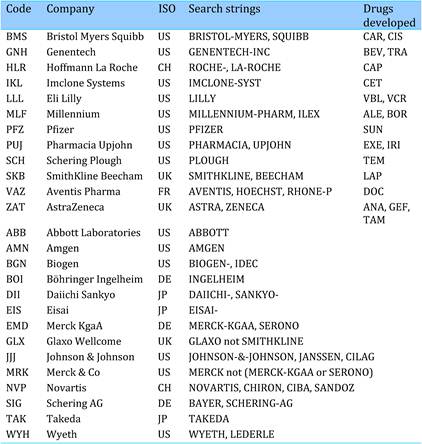

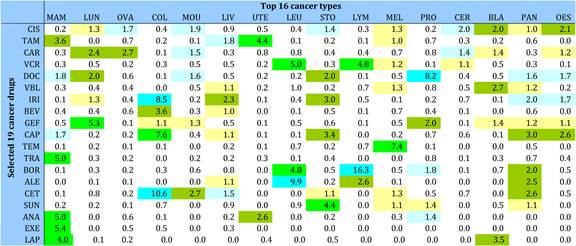

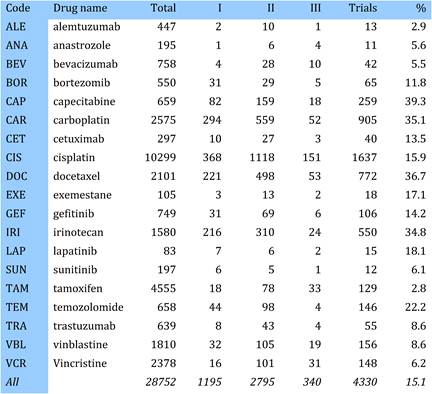

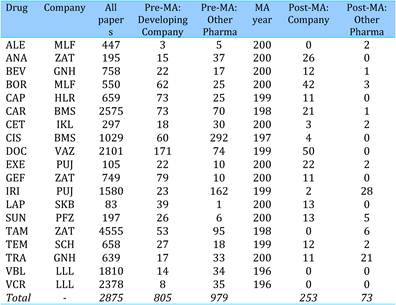

Table 4.1 Major 19 selected cancer drugs used for data collection

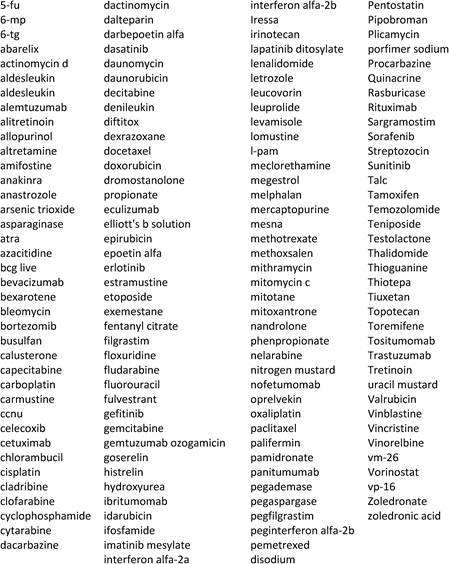

Table 4.2 List of all drugs listed as being approved for cancer treatment (2009)

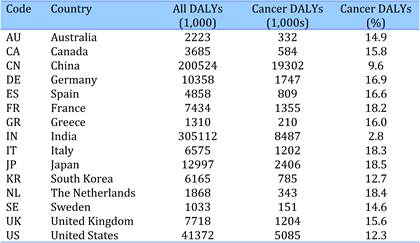

Table 4.3 Estimated total disease burden (DALYs) and cancer burden (DALYs, %) in 15 countries (2004)

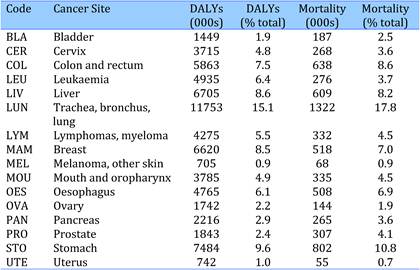

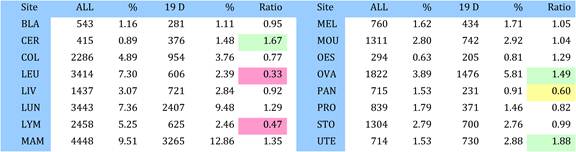

Table 4.4 Main 16 cancer sites, disease burdens (DALYs) and mortality rates (2004)

Figure 4.1 Total WoS output for 19 cancer drug research papers (3-year running means) (1970- 2007)

Figure 4.3 WoS cancer drug papers for 19 cancer drugs (1963-2009)

Figure 4.4 Distribution of papers in 15 countries (integer, fractional counts)

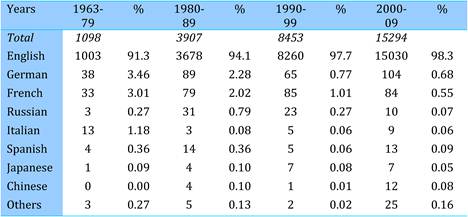

Table 4.7 Publication languages in cancer drug research papers (1963-2009)

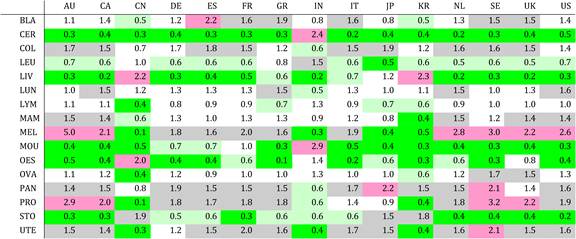

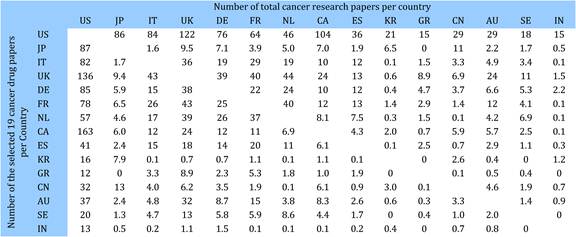

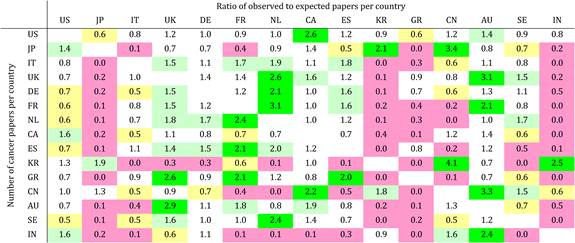

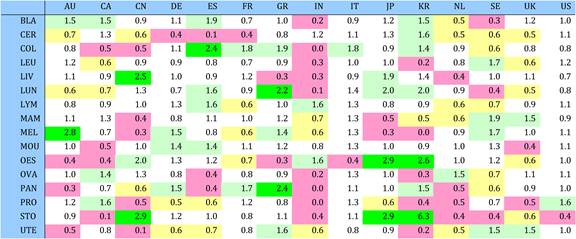

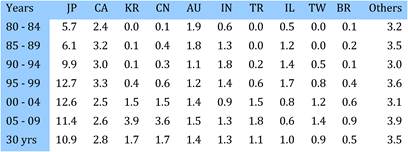

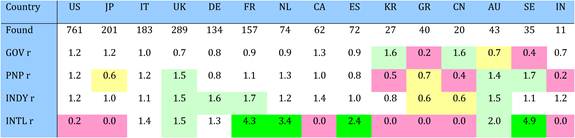

Table 4.9 Matrix of ratios of observed to expected cancer drug research papers per country

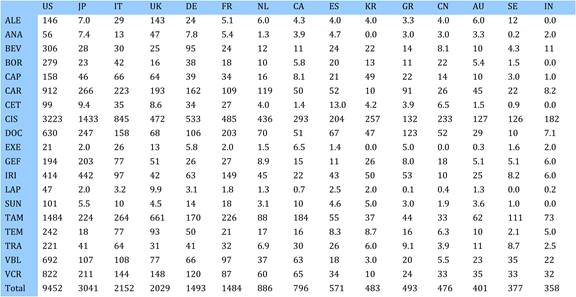

Table 4.10 Cancer drug paper ouputs in 15 countries for 19 selected drugs (fractional counts)

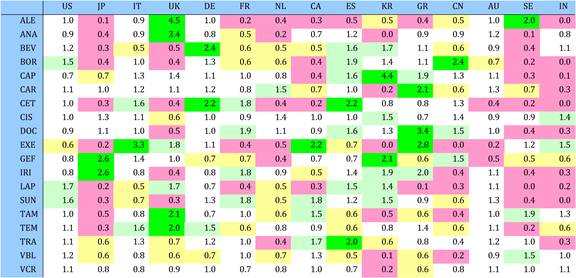

Table 4.11 Relative research concentration of the 15 countries for 19 selected drugs (1963-2009)

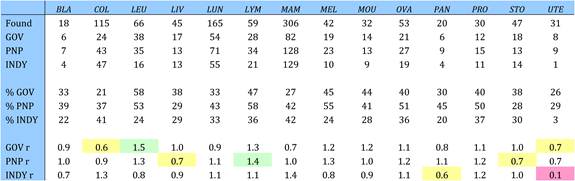

Table 4.13 Research paper outputs: 19 cancer drugs per top 16 cancer sites (1963-2009)

Figure 4.7 China: cancer drug research output versus burden from 16 cancer sites

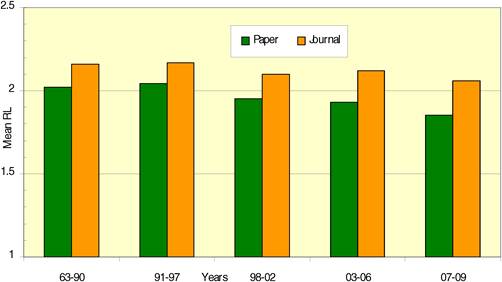

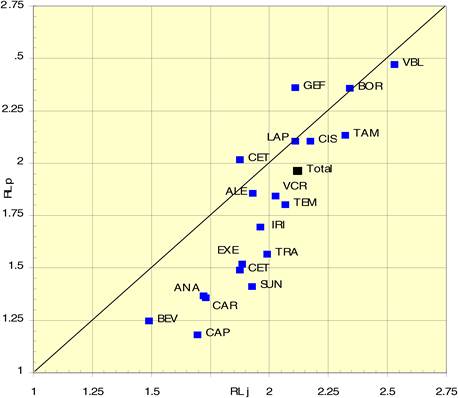

Figure 4.8 Mean research level (RL) of all cancer drug papers in five quintiles

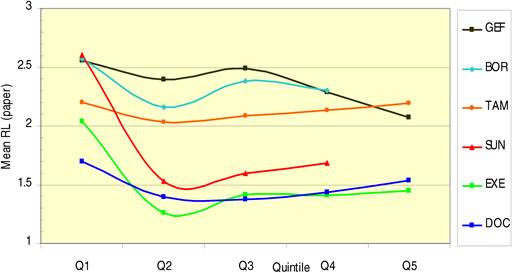

Figure 4.10 Average research level (RL) per time quintile for 6 cancer drugs

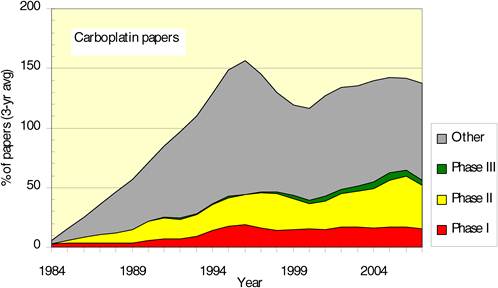

Figure 4.12 Phased carboplatin clinical trials longitudinal paper outputs (3-year running means)

Table 4.17 Phased clinical trials paper outputs in 19 cancer drugs (1963 -2009)

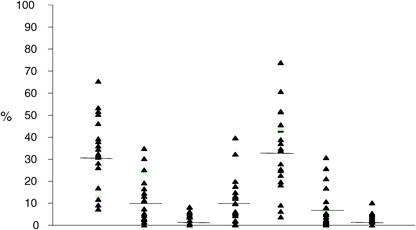

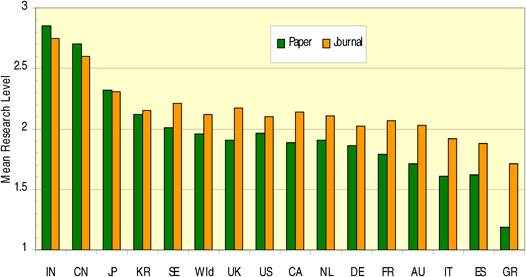

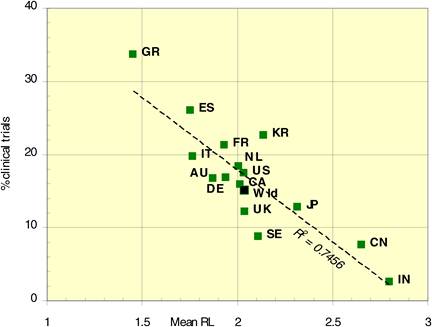

Figure 4.13 Percentage cancer drug clinical trials output per mean research level in 15 countries

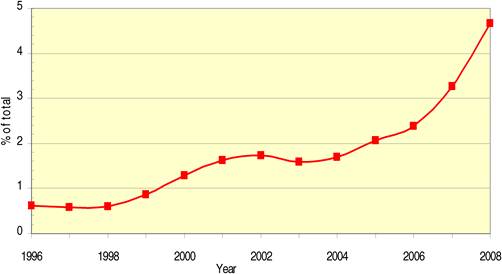

Figure 4.15 Chinese cancer drug papers, 3-year running means (fractional counts) (1996-2008)

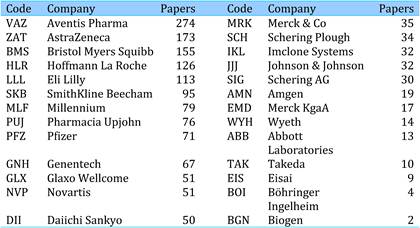

Table 4.19 Intramural papers in 19 cancer drugs per phama company (1963-2009)

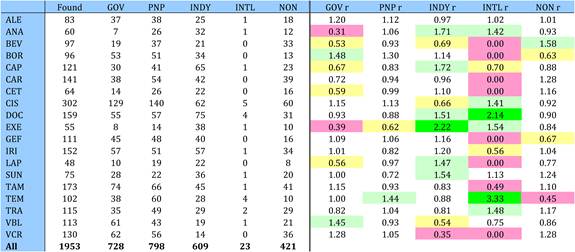

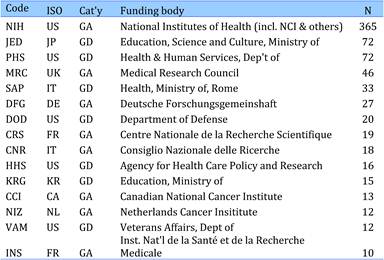

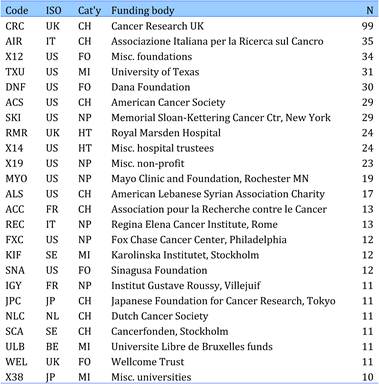

Table 4.21 Funding sources in 19 selected cancer drug papers (1963-2009)

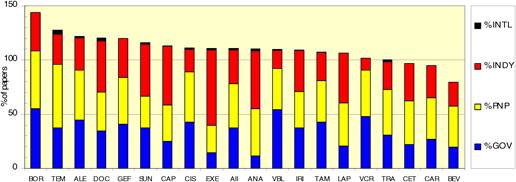

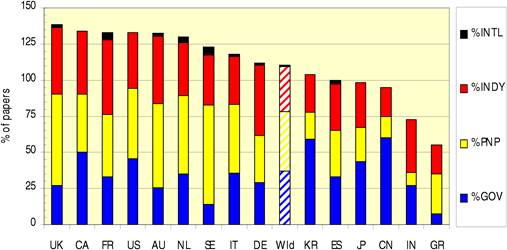

Figure 4.17 Funding sources in 19 cancer drug papers (1963-2009)

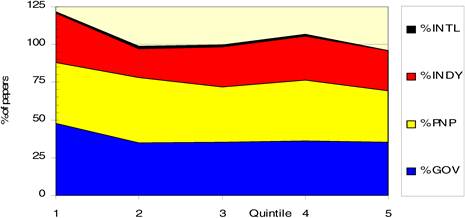

Figure 4.18 Funding sources for 6 out of 19 cancer drugs* in different time quintiles

Figure 4.19 Funding sources for cancer drug papers in 15 leading countries (1963-2009)

Table 4.23 Funding sources for cancer drug research papers in 16 cancer manifestations (1963-2009)

Table 4.24 Governmental organisations supporting cancer drug research (1963-2009)

Table 4.25 Non-profit organisations supporting cancer drug research (1963-2009)

Table 5.1 Strengths, weaknesses, opportunities and threats for public cancer drug development

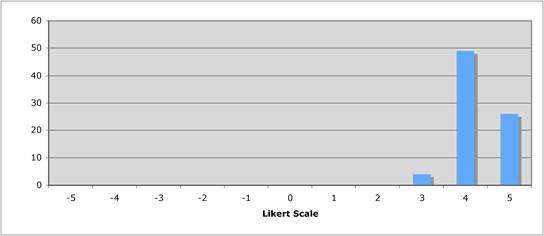

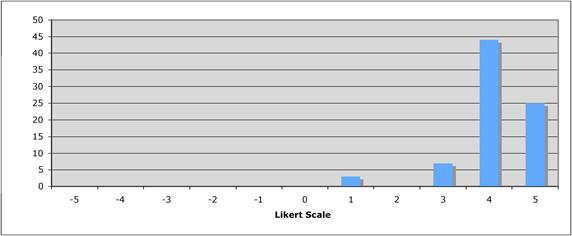

Figure 5.1 "Is private sector support for drug development essential?"

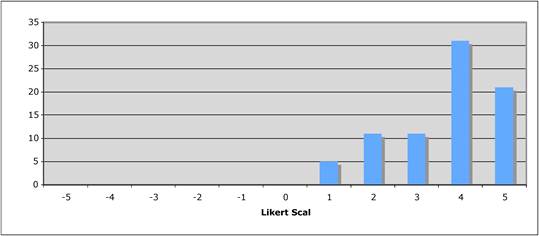

Figure 5.2 "Is the current level of national public sector investment adequate?"

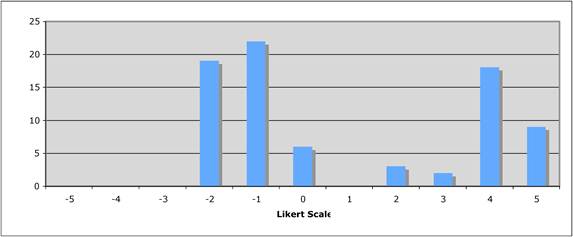

Figure 5.3 "Does the public sector have a limited role in cancer drug development?"

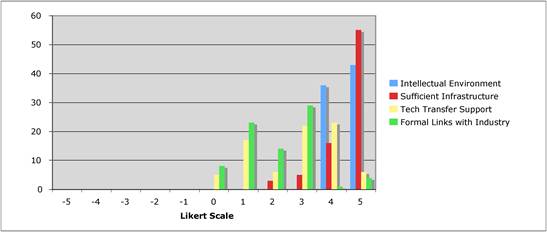

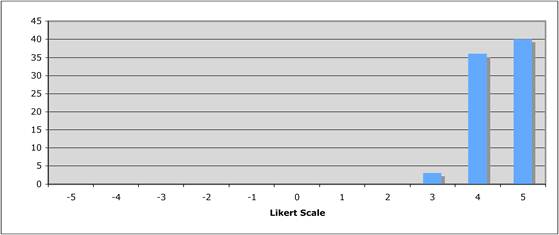

Figure 5.4 "How important is the intellectual (academic faculty) environment?"

Figure 5.5 "Are financial incentives important for public-private partnerships?"

Figure 5.6 "Should private sector support be short term project based?"

Figure 5.7 "Should nationalisation of parts of the drug development process be considered?"

Figure 5.8 "Is the balance between private and public cancer drug development correct?"

Figure 5.9 "Is the regulatory environment a key area for success?"

Figure 5.11 "How important are supra-national funding initiatives?"

Figure 5.12 "How important are national funding policies from research funding organisations?"

Figure 5.13 "Is institutional support important for success in cancer drug discovery?"

Figure 5.14 "Are technology transfer and / or incentive schemes important policy areas?"

Figure 5.15 "Are new models in PPP are needed?"

Figure 5.16 "New models for R&D in cancer drug discovery and development are needed"

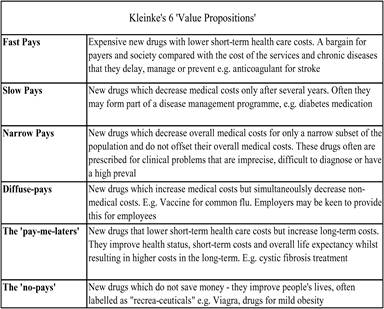

Table 6.1 The six economic categories for innovative medicines

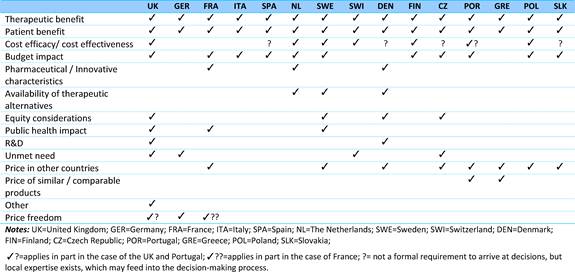

Table 6.2 Criteria for assessing new technologies in 15 EU countries (2009)

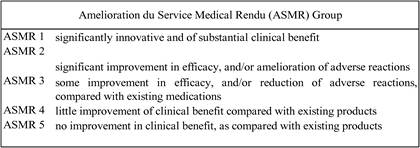

Table 6.3 ASMR categories in France

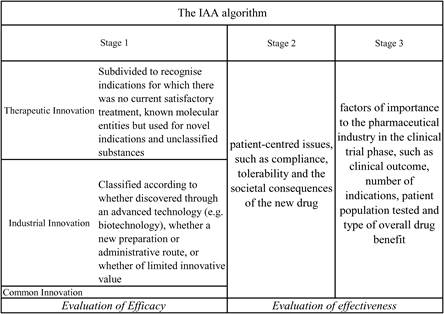

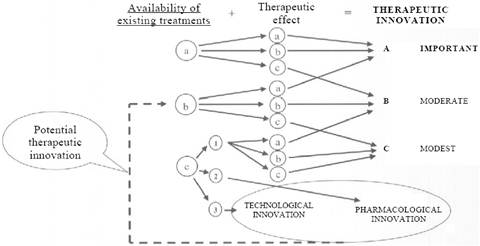

Figure 6.1 Assessing therapeutic innovation in Italy

Table 6.6 The benefits of pharmaceutical innovation1

List of Abbreviations

|

ABPI ACI ACS AHCPR AICR ASMR BBSRC BCG CCLG CCRA CDC CML CMR CRADA CRUK CSC CSO DALYs DC DCE-MRI DHHS DNA DOD DOE DoH EC ECMC EDCTP EFPIA EFRR EFTA EMEA EPA ESRC EU FDA FECS FP GAVI GDP GFATM GMP HBV HCFA HER2 HIV HPV ICR ICRP IFN-a/g IL-2 IMI INCA IOM IOM IPR IPR ITCC JPMA MA MAb MDR MEPS MRC NASA NCE NCI NCRI NDA NGO NHS NIH NK NME NSCLC NSF P CG P GOV P MED P TB PCI PET PhRMA PIP PR QA QC R&D RaDiUS RFO RL j RL p RNA ROI RoW SENDO SFOP SIOPE SmPC SPC SSRI SWOT TCA TILs TNF-α TRAP UJ USA USDA USTPO VA VEGF WHO WoS |

Association of British Pharmaceutical Industry (UK) Actual citation impact American Cancer Society (USA) Agency for Healthcare Research and Quality (USA) American Institute for Cancer Research (USA) Amelioration du Service Medical Rendu (France) Biotechnology and Biological Sciences Research Council (UK) Bacillus Calmette-Guerin Children's Cancer and Leukaemia Group Canadian Cancer Research Alliance (Canada) Centers for Disease Control and Prevention (USA) Chronic myeloid leukaemia Centre for Medicines Research Cooperative research and development agreements Cancer Research UK (UK) Cancer stem cells Common Scientific Outcome Disability adjusted life years Dendritic cell Magnetic resonance imaging Department of Health and Human Services Agencies (USA) Deoxyribonucleic acid Department of Defense (USA) Department of Energy (USA) Department of Health (UK) European Commission Experimental Cancer Medicine Centres European and Developing Countries Clinical Trials Partnership European Federation of Pharmaceutical Industries and Associations Epidermal growth factor receptor European Free Trade Association European Medicines Agency Environmental Protection Agency (USA) Economic and Social Research Council (UK) European Union US Food and Drug Administration (USA) Federation of European Cancer Societies Framework Programme Global Alliance for Vaccines and Immunisations Gross Domestic Product Global Fund to Fight AIDS, Tuberculosis and Malaria Good manufacturing process Hepatitis B Health Care Financing Administration (USA) Human epidermal growth factor receptor 2 Human immunodeficiency virus Human papilloma virus Initial Cancer Research Partners International Cancer Research Portfolio Interferon, alpha/gamma Interleukin-2 International Medicines Initiative Institut National du Cancer (France) Institute of Medicine Institute of Medicine (USA) Intellectual property rights Intellectual property rights Innovative Therapies for Children with Cancer Japan Pharmaceutical Manufacturers Association Market Authorisation Monoclonal antibodies Multi-drug resistance US Medical Expenditure Panel (USA) Medical Research Council (UK) National Agency for Space Exploration (USA) New chemical entity National Cancer Institute (USA) National Cancer Research Institute (UK) New drug applications Non governmental organisations National Health Service (UK) National Institute of Health (NIH) Natural killer New molecular entity Non-small cell lung cancer National Science Foundation (USA) % of papers on clinical guidelines % of papers on government policy % of papers in mass media % of papers in text-books Potential citation impact Positron emission tomography Pharmaceutical Research and Manufacturers of America Paediatric investigation plan % of reviews Quality assurance Quality control Research and Development RAND Corporation's Research and Development in the US database Research funding organisations Research level journals Research level titles Ribonucleic acid Return on investment Rest of world Southern Europe New Drug Organisation French Society of Paediatric Oncology International Society of Paediatric Oncology Summary of Product Characteristics Supplementary protection certificate Serotonin re-uptake inhibitors Strengths, Weaknesses, Opportunities and Threats Tricyclic anti-depressants Tumour infiltrating lymphocytes Tumour necrosis factor, alpha Target related affinity profiling Utility of journals United States of America US Department of Agriculture (USA) US Patent and Trademark Office (USA) Department for Veterns' Affairs (USA) Vascular endothelial growth factor World Health Organisation Web of Science |

EXECUTIVE SUMMARY

During the past two decades, cancer incidence has steadily increased due to aging populations, lifestyle and environmental factors, with great personal and national economic consequences. Concurrently, cancer treatments have improved with increased treatment options as well as lengthier disease and disease-free survival rates. The latest innovation in cancer treatments are targeted biological treatments, joining the current arsenal of surgery, radiotherapy and chemotherapy, particularly significant in latter stage cancers associated with very poor survival.

Despite this latest breakthrough in cancer treatment, this has in fact only opened the door to beginning to understand the complexity of cancer on a molecular and genetic basis. Oncology research and development (R&D) has the highest failure rate for new molecular entities (NME) and significantly higher development costs. Although tremendous scientific and economic barriers exist, the oncology development market has increased twofold over the past 5 years.

This report aims to map current oncology R&D funding and management, primarily in Europe and the USA, to examine public-private relationships, current oncology R&D strategies and oncology innovation policies. Its objectives are:

- to map current funding and management of oncology R&D via questionnaire surveys and interviews of oncology experts;

- to produce a high-resolution bibliometric analysis of oncology drug R&D in order to better understand the public-private mix in research activity;

- to investigate the cumulative life-time funding of specific oncology drugs;

- to review current public policy affecting oncology drug R&D, specifically, public R&D investment policies, transnational investment policies, regulatory policies and drug reimbursement policies; and

- to propose future oncology policies supporting the R&D process.

Results: Funding, Bibliometric Outputs and Faculty Survey

Funding

Public oncology R&D funding can be sourced from a variety of sources: national governments, regional authorities, charities, non-governmental organisations and supranational organisations. Funding can be directly tagged for oncology research from these organisations or indirectly flow into oncology research via overall budgets (i.e. hospital budgets).

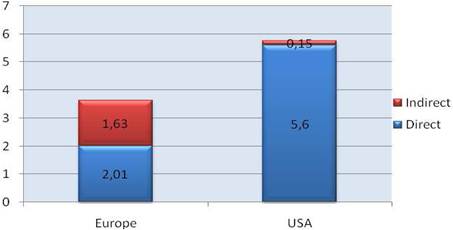

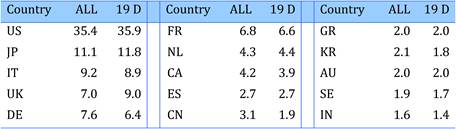

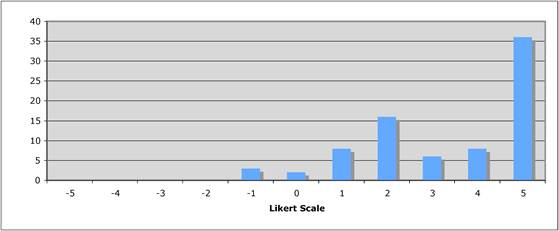

Our examination of oncology funding found 153 public research funding organisations (RFO) in the EU (UK 19, France 12, Belgium 12, Italy 11) and 21 in the USA who spent greater than €1 million annually. The EU RFOs collectively spent €2.79 billion and the US RFOs €5.8 billion, although the EU did not include European Commission (EC) investment, which is significant and likely brings the EU figure closer to €3 billion. Individually, the US and the UK (€1.1 billion) were the largest oncology public R&D investors, whilst Germany (€426 million), France (€389 million) and Italy (€233 million) followed. Calculations per capita found leaders (USA, UK) unchanged, however, placed Sweden, the Netherlands and Norway next. Likewise, examination of public oncology drug R&D investment placed the USA (€1.67 billion) and UK (€305 million) at the top, regardless of absolute or per capita valuation. When direct and indirect funding are added together, the EU invests 0.011% of GDP, or €3.64 per capita, and the USA 0.018% GDP, or €5.74 per capita. Furthermore, the EU has significantly increased funding by 34.7% from 2004 to 2007 whilst the USA increased only 9.7%.

Examination of national cancer strategies and funding found only the United States and United Kingdom with strong visions and policies, whilst the remaining EU countries appear to favour an ad hoc approach. Philanthropic oncology remains impressive, estimated at over €500 million Europe and €230 million in the USA in 2007. Private oncology investment by the top 17 pharmaceutical companies globally in 2004 amounted to €3.1 billion, 59% from European companies. In addition, public-private partnerships (PPP) are becoming more common and found in 68% in the United States, 57% in the EU and 31% elsewhere of new oncology drug R&D projects.

Bibliometric analysis

Bibliometric analysis of 19 anti-cancer drug publications (1963-2009) produced 28,752 papers for analysis. Paper outputs rose from 200 annually in 1980 to 2000 by 2007-2008. Examination of 15 main oncology research countries found the USA the leader (33%) followed by Japan (10.6%), Italy (7.5%) and the UK (7.1%). Initially, the USA and Europe dominated oncology research outputs, although recently other counties such as China and India are increasing their publication outputs.

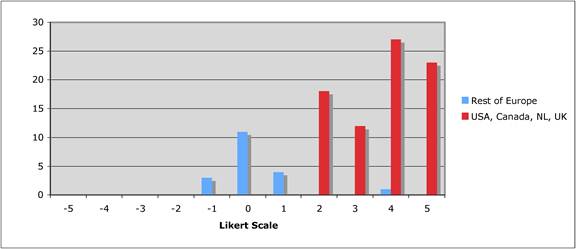

Neighbouring countries still favour each other (USA: Canada, UK: NL) despite increasing international collaboration. Further, countries appear to concentrate on certain drugs and produce less research on others. Surprisingly, most national oncology research portfolios were poorly correlated with their internal oncology burden.

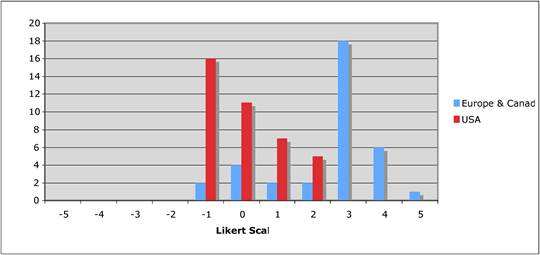

The type of oncology research performed changed with time from basic to clinical, although per drug this was not necessarily the case. Different countries produced different types of research (i.e. basic: India, China; clinical: Spain, Greece), with 15% of papers describing phased clinical trials, primarily Phase II.

The presence of 26 leading pharma companies, including the 12 associated with development of the 19 selected drugs, occurred in 1589 papers, or 5.5% of the total. Dominating companies responsible for oncology paper outputs were Aventis (274 papers), AstraZeneca (173) and BristolMyerSquibb (155).

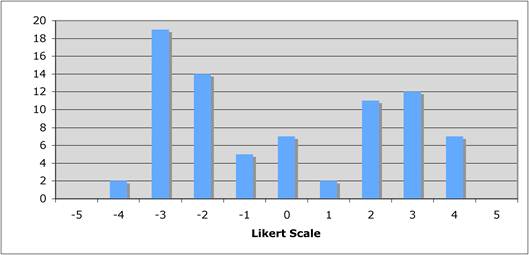

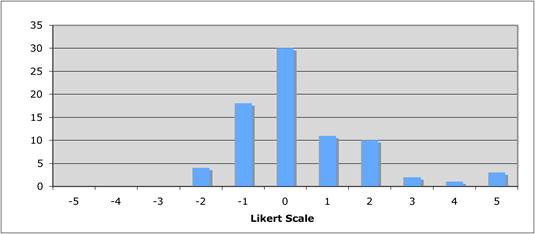

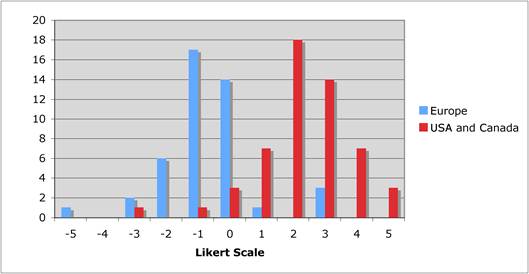

Survey of oncology faculty

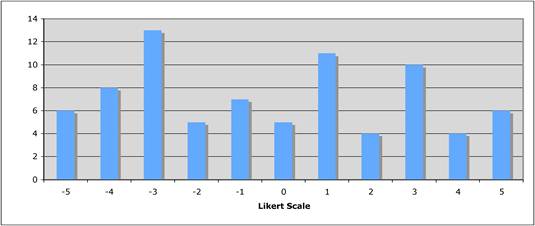

Faculty were surveyed on a number of public and private oncology R&D issues. They felt strongly that PPP were important for future oncology developments, however, its ideal definition was not clearly defined regarding financial incentives and length of private support. Europeans were less agreeable regarding oncology R&D nationalisation than Americans and Canadians, whilst American faculty felt reimbursement policies for new oncology drugs was less important to future successes. All agreed, however, that the degree of national public sector investment was inadequate to meet future oncology demands.

Faculty expressed concern about the inadequacy of current oncology R&D models and encouraged re-thinking of ideal models. Suggestions included greater transnational cooperation, support of translational research and a degree of institutional involvement. Specifically, regulatory bottlenecks must be resolved as well as ideal balance of public versus private funding.

Policy Implications: Funding, Bibliometric Outputs and Faculty Survey

Our funding analysis produced a number of interesting issues. First, it appears there are funding gaps between the USA and Europe, supplemented by further variations within Europe. Second, it appears public funding is more likely to support basic rather than applied research, whilst industry supports the latter. Third, European funding appears to be fragmented concurrently with duplication and inadequacies. Fourth, indirect and philanthropic funding appear to be significant and uncounted sources of oncology funding. Fifth, PPP investment in oncology is of increasing importance in addition to being complex, reducing economic risk, smoothing the operations process and will likely play an increasing role in the future.

Our survey of oncology faculty found substantial support for PPP although its ideal definition remained unresolved. Both public and private sources of activity and funding are important to oncology, yet the balanced equation of their interaction and involvement needs further study. New models specifically for oncology R&D are urgently needed to reduce attrition rates, increase the rate and sophistication of parallel biomarker development and work on the vast number of combination regimens and indications necessary for the next generation of cancer drugs.

New PPP policy development should include a number of new variables.

- Strong institutional support and dedicated public RFO funding.

- Increased freedom to operate for translational leads within specific projects, achieved by improved support, light-touch governance and decreased administrative bureaucracy (national legislative, private-contractual, public contractual).

- Partnerships supporting transnational cooperation and collaboration focused on key cancers, including 'orphans' not viewed as commercially attractive.

- Partnerships subject to high-quality peer review and fully disclosable upon completion to the public.

Faculty clearly identified over-regulation and reimbursement of new cancer drugs as critical issues, which continues to overshadow public sector oncology R&D and remains a threat to future new breakthroughs. Of further significance was intellectual environment and infrastructure for oncology R&D, expressed as vital to institutional and national policies. Strategic alliances and cooperation between industry and academia are key to future oncology discoveries, as the complex nature of oncology research cannot support monopoly in knowledge and creation. Particularly for novel biologicals this holds true

Fostering Oncology Innovation

Encouraging innovation in oncology brings forth a number of priorities: first, the role of science, research and innovation; second, the role of pricing and reimbursement systems; third, the continuous evaluation of oncology drugs; fourth, the ideal environment for long-term innovation and fifth, the optimisation of resource allocation in health care.

National and Supranational Roles in Innovation

Governments play an important role in encouraging and fostering innovation, including direct governance for key research areas and indirect mechanisms including taxation. Governments understand this encouragement has direct economic consequences as well as social benefits, which exceed private benefits. Collaboration between public and private enterprises further spreads benefit and ensure greater likelihood of success.

Despite this recognition, the complex nature of oncology requires both direct and indirect measures. Using only prescriptive and coercive regulations may be cumbersome, expensive and inefficient, whilst output- or performance-based regulations may have more likelihood of success. Tax incentives via R&D credits may be targeted to serve specific objectives, whilst enhanced market exclusivity periods may encourage intellectual creativity. Particularly in oncology research each player only has a portion the knowledge required for presenting new solutions, leading to ideally open access requirements. This presents the need for new model developments in oncology R&D to encourage innovation, leading to new treatments more quickly.

In Europe, the EC has recently taken steps to encourage innovation by promoting translational and transnational research, in addition to PPP, in the hopes that cooperation will prove stronger than its current fragmentation. Although not all European countries have cancer strategies in place, particularly newer members, there is focused application to improve oncology treatments and to encourage development of new ones. Despite this attention, there continues to be room for improvement in European oncology R&D. Cancer charities are a significant yet neglected source of oncology funding, their fragmentation and duplication continues to be mirrored by many national oncology organisations. Furthermore, some oncology research may not be funded due to precisely its specialisation and innovation, such as very specialised basic cellular research found in only few countries, as it does not qualify for translational or transnational funding.

In America, cancer research is less fragmented due to the umbrella organisation of the National Cancer Institute, which supports both molecular and translational research as well as increasingly encouraging PPP. However, it does suffer from state-level and indirect fragmentation (i.e. hospital research budgets), and its level of charitable oncology R&D funding is less than the EU.

Globally, it appears translational cancer research is still in its infancy, only recent programmes giving focus and direction. Likewise, PPP have room for growth and direction both in Europe and the US which should be seen as a unique opportunity at these cross roads. Fragmentation continues, particularly at charitable level, with some negative consequences for administration costs and research duplication, but perhaps benefiting highly specialised research areas still in experimental stages.

The Uniqueness of Rare Cancers

Rare cancers represent approximately 20% of oncology cases, including childhood cancers, each with variations in incidence, mortality and survival rates. This variability is mirrored between EU members with regards to treatment access, information availability and medical expertise. These factors present rare cancers as a unique case, requiring multidimensional action to encourage R&D, access and uptake of new treatments. Such actions include re-organising regulations, encouraging R&D through collaboration, creating consensus guidelines on multidisciplinary treatment, addressing patient treatment access, as well as improving information access for patients and health care professionals.

Role of the Reimbursement System

Over the past decade, health care costs have increased, including drug spending although only accountable for 10%-20% of total care costs. Management of drug spending is important, particularly as regressive management may cause access, equity and health outcome issues. Appropriate pricing and reimbursement can help manage health care costs whilst concurrently encouraging innovation in R&D and treatment. A number of criteria can help achieve these goals.

First, timely treatment access is paramount, particularly for innovative drugs, and encouraged through 'fast track' approval and reimbursement procedures (e.g. FDA fast track process for priority drugs). Conditional reimbursement and pricing, where access is ensured whilst 'real-world' data collection continues, as well as physician flexibility in prescribing can further aid access and encourage innovation.

Second, reimbursement based on values, including explicit and objective assessments, is important to consider. This value should consider both societal and individual value and include comparisons to current best practice. Third, reimbursement and pricing policies should contain some degree of flexibility, where levels are adjusted as new data become available.

Fifth, collaboration should be encouraged between payers, providers and manufacturers to explore new pragmatic ways of delivering innovative value. Sixth, standard guidelines to assess drug benefits should include humanistic and patient-focused benefits such as quality of life (QoL), longer term direct cost offsets, indirect system costs and caregiver and patient benefits.

Risk Sharing

Traditionally, payers absorb all risks associated with purchasing new medical technologies. Risk sharing attempts to redistribute the risk balance between payer and technology supplier, typically involving the supplier to provide a 'guarantee' relating to outcome. These outcomes could include clinical parameters, QoL, resource usage, (d) financial and economic outcomes. Although new in health care, this method is likely to gain use in the future due to total cost issues, first, for admitting new treatments onto national formularies and, second, to enabling faster uptake. In oncology in particular, this could be interesting due to limited patients carrying the same genetic tumour codes.

Continuous Evaluation of Oncology Drugs

Ex-ante evidence is currently required to present evidence for approval and reimbursement decisions, however, sole reliance on this method ignores evidence outside the clinical phase environment. Ex-post evidence is just as important, however, in proving value of new treatments yet is widely ignored. Collection and evaluation of such data is costly and perhaps should be shared between private and public interests, yet is imperative in oncology with its heterogeneous patients.

Optimising Resource Allocation in Health Care

Although resources are allocated mechanistically in health care, this does not guarantee optimal use in fact evidence suggests that many health systems have room for improvement including oncology. Demand-side behaviours by both clinicians and patients, real-time information systems for payers and providers as well as system and policy performances all must be considered. Savings emerging should be re-allocated and re-invested to improve patients' quality of care and health services.

Conclusions

The report shows oncology R&D and treatment are on the brink of a new era, providing a unique opportunity now to redirect and refocus national, supra-national as well as regional policies and procedures that may impact oncology directly or indirectly. New models for PPP must be created, giving credence to both public and private ownership within complex and often unique diseases including cancer. Reimbursement decisions are important and can greatly impact future oncology innovation and investment and must be carefully considered prior to implementation (and monitored closely thereafter). Pricing should consider innovation and value, not just with macro-societal views but also consider micro-individual patients. The overall goal is improved patient outcomes and survival, and for oncology this means collective operation and collaboration.

1. BACKGROUND AND OBJECTIVES

1. 1. The Burden of Cancer

1.1.1. Risk factors, incidence and mortality

The aging of population and lifestyle factors such as obesity, physical inactivity, alcohol consumption, rising number of female smokers and lower rates reproduction, along with genetic susceptibility are among the most important underlying reasons for the increasing cancer incidence in industrialised nations [1,2]. However, the burden of cancer is no longer limited to developed countries. On top of the growing risks of poor diet, tobacco, alcohol and industrial exposures, the less developed world is already burdened with cancers related with infectious agents [3] such as Helicobacter pylori, human immunodeficiency virus (HIV), hepatitis B (HBV), human papilloma virus (HPV) and others [2]. Even if the total burden of cancer remains highest in wealthy countries, developing countries are closing the gap rapidly.

Advances in diagnostic methods, surgical techniques, radiotherapy, innovative vaccines and drug treatments have contributed to improved outcomes, particularly for patients suffering from the most ordinary cancers such as prostate, breast, colorectal and, more recently, lung. Thus, mortality rates have stabilised in some populations (e.g. Europe) [1].

Still, new cancer cases were estimated at 11.47 million worldwide in 2004, whilst cancer accounted for 7.42 million deaths that same year (Table 1.1, Figure 1.1) [4]. These figures could reach 27 million cases by 2030 with 16 million deaths [5], making cancer as cause of death the fastest increasing rate globally, and in some countries already the primary cause of adult mortality (the United Kingdom, the Netherlands) [4]. In most high-income countries, cancer is the second highest common cause of death after cardiovascular disease, with lung, colorectal, breast and stomach cancers together accounting for 13% of total mortality in 2004 [4].

Table 1.1: Global cancer related deaths and burden of disease by sex (2004)

Source: [4].

1.1.2. Prevalence and direct/indirect costs

Cancer prevalence refers to the burden of disease in a population and is associated with the survival of cancer patients. In terms of total disease burden, malignant neoplasms accounted for 14.6%, 7.2% and 2.3% of disability adjusted life years (DALYs) ('healthy' years lost) in high-, middle- and low-income countries, respectively, in 2004 (4) (Table 1.1, Figure 1.1). In the EU25 and the USA, cancer ranks third behind mental and cardiovascular disease in relation to DALYs lost whilst in other industrialised countries such as Australia, Japan and New Zealand, cancer ranks second relative to DALYs lost, following mental illnesses (1).

Figure 1.1: Cancer related deaths and burden of disease grouped by income per capita (2004)

Source: [4].

Despite the rising burden that cancer poses, health spending related to treatment of cancer patients does not reflect this trend. Based on 2004 total health expenditure figures from OECD Health Data, cancer care seems to account approximately for 6.6% (on average) of total direct health care expenditures in most developed countries [1]. Medical treatments for cancer account for 10%-20% of cancer expenditure primarily as inpatient hospital care and 5% of total pharmaceutical expenditures [1].

Indirect costs associated with inability to work account for a large proportion of the total cost that cancer imposes on society. Relevant studies demonstrate that indirect costs range between 65%-85% of total costs [6-8].

1.1.3. Advancement in cancer medical treatments

Various treatment methods exist today for cancer, including surgery, classical chemotherapy (i.e. agents that inhibit cancer growth such as alkylating agents and anti-metabolics [9,10]), radiotherapy and an increasing number of 'targeted' drugs against hormone, and growth factor receptors as well as cell-signalling pathways.

Cancer drugs are often introduced into clinical management in late-stage patients [1]. Efficacy in early-stage disease often translates to greater success rates when the drug is combined with surgery and/or radiotherapy [1]. Multiple drug regimens are the backbone of treatment and the newer generation of cancer drugs promise reductions in toxicity, improved tolerability and, in the case of orally delivered medicines, economic benefits and increased patient satisfaction by out-of-hospital and in-community treatment delivery.

The analysis of tumour gene/protein expression profiles, as well as other technologies such as circulating cancer cells, has driven the 'translational' science of prognostic and predictive biomarkers. In the latter case, such markers can help predict whether a tumour is likely to respond to a certain treatment, the so-called personalised medicine. However, progress in genomics and proteomics has also revealed that most tumours are in practice genetically unique and highly complex. Laboratory and clinical development of these new biomarkers along with the next generation of cancer drugs is extraordinarily complex. As a result, the already costly and timely research and development (R&D) process in cancer drug development becomes even more challenging.

1.2. The R&D Process

1.2.1. General trends

Recent advances in genomics, proteomics and computational power present new ways of understanding the inner workings of human disease at molecular level, making discovering and developing safe and effective drugs challenging as well as promising.

Scientists in government, academic, not-for-profit research institutions and the pharmaceutical sector contribute to basic research in order to understand the disease and choose a target molecule. In general, it takes about 10-15 years to develop one new medicine from the time of discovery to when it is available for treating patients. Moreover, substantial research has been carried out on estimating the costs of drug development either generally [11] or according to therapeutic area [12], and, although there is controversy around the use of single numbers [13], it is clear that it takes a large, lengthy effort to get one medicine to patients. In 2005, the average cost of developing drugs against cancer was estimated to be 20% higher (€964 million) than the mean cost of developing a new molecular entity (NME) (€803 million) [11]. This number incorporates the cost of failure: For every 5000-10,000 compounds that enter the R&D pipeline, ultimately only one receives approval [14].

1.2.2. Cancer R&D

Over 50 years ago when cancer was described for the first time as a genetic disease, hopes for early diagnosis and targeted treatments rose. However, the progress in genomic technologies and fundamental cancer biology has unravelled a complexity among cancers practically making each tumour's genetic fingerprint unique [15]. Therefore, it is of no surprise that oncology R&D has the lowest success rate (and, by implication, the highest cost) of any therapeutic area in the pharmaceutical discovery and development, making the R&D process even more challenging for a number of reasons. Indeed, in the case of cancer, when a molecule enters clinical trials, there is only a 5% probability that it will turn out to be a commercially viable product [16].

There are further R&D issues unique to oncology. First, instead of healthy volunteers, patient populations who have practically failed all other treatments participate in Phase I clinical trials. This imposes a major burden on the assessment of the safety and efficacy of the compound, as well as the identification of relevant biomarkers. A Phase II trial, where specific cancer types are being selected and dosage is determined, is often more enlightening. Second, contrasting most diseases, cancer is a set of proliferative diseases representing a variety of different specific conditions. Third, there are huge differences among cancer patients due to the unique genetic fingerprints that almost any tumour has, making inter-patient heterogeneity a major challenge. Finally, even if the drug makes it to Phase III, cancer patients are normally treated with multiple drugs at the same time, thus the standard of care has to be adapted and enhanced to add the new drug to it. Perhaps, it is not surprising that cancer drugs often fail in Phase III, which is the most costly part of drug development programme.

The current knowledge of the biology of cancer targets and their significance in the disease process is undoubtedly deficient and major problems remain in how to deliver many anti-cancer agents that in vitro are effective. What seems to become increasingly likely is that there will be a shift from defining a cancer by site [17-19] (i.e. malignancies originating from the same organ system are grouped together as one single disease, receiving basically the same treatment) to identifying similar therapeutic target cancers that, regardless of whether they arise in the same locations or not, share alterations of the same genes. Thus, successful cancer drug discovery will require, apart from finding the best medicine for a certain target, also identifying the patient population whose tumours actually carry the relevant genetic alteration, leading to both individualised diagnosis and personalised therapy.

The issue arising here is that treating cancer as a collection of 'orphan diseases' could lead to the creation of smaller markets, inapt to the traditional 'best-seller' model of discovering and developing new cancer drugs [20]. Indeed, some pharmaceutical companies have been reluctant to invest in early basic science and pre-clinical research and development, given the limited revenue prospects of such a business model.

In the end, it seems that the overabundance of these potential targets are major scientific hurdles to issues of drug delivery, target appraisal and confirmations and potential medicines manufacturing and effectiveness enhancement. Furthermore, the development of new therapeutic strategies is too much for industry, government or universities to do separately. Collaboration appears to be the key to facilitate the discovery and development of effective new cancer drugs and optimise their application.

1.3. Trends in R&D Spending and Output by the Private Sector

1.3.1 Aggregate R&D trends in pharmaceutical and biotechnology industries

Whilst total pharmaceutical R&D expenditurea has increased and salesb have grown, revenue keeps on relying on a small number of molecules reflecting an ongoing drop in productivity (Figure 1.2).

R&D costs continue to rise with development, now corresponding to approximately one third of all spending. Development times also continue to grow during all phases of development. Discovery and regulatory times have not marked any significant change during the past 5 years and are not expected to do so in the years to come [21]. Still, there is an obvious trend in some companies to invest more in early development in order to avoid the massive cost of late-phase failure.

Figure 1.2: Global R&D expenditure, development times, NME output and global pharmaceutical sales (1997-2007)

Notes: Each trend line has been indexed to 1997 values Development time data point for 2007 includes data from 2006 and 2007 only

Source: CMR International and IMS Health

On the other hand, success rates are not improving as only 20% of molecules entering Phase II will be marketed. Biotechnology-derived and self-originated substances do have, however, a slightly better chance of success relative to chemical and in-licensed entities [19]. Consequently, the number of NME launches dipped to a new 20 year low in 2007, despite the encouraging signs in 2005. In fact, during the 1997-2007 period, the introduction of NME dropped by 50%. Yet, biotechnology products have accounted for almost a quarter of all NME launches [19].

The molecules currently in development are mainly looking at therapeutic areas with high value and significant level of unmet medical need [13,20]. The underlying rationale is that although molecules with a new action mode are associated with a significant success risk, at the same time they offer the greatest opportunity for innovative and high-value medicinal products [22].

1.3.2. Cancer R&D trends

As previously been described, R&D in the area of oncology is particularly challenging. However, oncology-related R&D is booming, and this is shown by the enormous share of oncology compounds in the pharmaceutical sector's clinical pipeline. In the USA alone, there are more than 800 new compounds in development for cancer in 2009, compared with 750 in 2008 and just under 400 in 2005c (Figure 1.3).

Figure 1.3: Number of new cancer drugs in development by type of cancer

Note: Some drugs are listed in more than one category.

Source: PhRMA ('New medicines in development for cancer').

This reality reflects the focus of R&D investments towards therapeutic areas and technologies of greatest opportunity (perceived as a combination of low-generic penetration and high price levels), associated with the highest unmet medical need. Hence, the opportunity associated with a potential success cancels out the fact that attrition rates among cancer products are as high as 95%.

1.4. Aim of This Report

The global organisation and funding of cancer research follows many different models. The global flow of knowledge, innovation, research and development has dramatically increased the complexity of cancer research. Since the mid-1950s cancer drug development has become the dominant area of cancer research. The clinical need to find drugs to prevent cancer, suppress recurrences (adjuvant), downstage tumours for surgery (neoadjuvant), treat metastatic disease and palliate has driven the development of new molecular entities, be they chemical or biological.

However, the vast complexity of this nexus coupled to the widely different paradigms that appear to operate across Europe, USA and the Far East do not easily lend themselves to strategic analysis. In particular questions arise as to:

- what models of funding and management have, or have not been successful;

- what is the most efficient, creative and innovative model for public-industry cooperation and collaboration; and

- what policies should we be developing to support drug development in cancer, and to whom should these be directed (government, NGOs, etc).

In this context, the aim of this report is to map out the current funding and management structures for cancer drug R&D in Europe and the USA, with particular reference to the public-private interplay, and following a review of current strategies put forward recommendations to improve cancer drug innovation.

The report focuses on the USA, Germany, UK, Italy, France, the Netherlands, Sweden and Spain primarily, but also includes evidence from EU27 and Canada, where it is available. Although the main focus is on adults, the report includes paediatric oncology as drug development in this area is now a critical public policy issue.

The detailed objectives of the research presented in the report are fivefold:

First, to map current funding, peer review and management of cancer drug development. Through a mixture of questionnaire- and interview-based techniques, the current funding in oncology, peer review and management practices is mapped for the countries in question. This encompasses pre-clinical drug development, early phase clinical trials through to pivotal Phase III, although in the latter case this is assumed to be entirely within industry. The report covers both New Chemical Entities and Biologicals. This addresses the question as to who funds what and how. Within the institutional part of this mapping exercise the report drills down into the availability (or otherwise) of key platform technologies and infrastructure for the pre-clinical and clinical aspects.

Second, the report conducts and presents a high-resolution bibliometric analysis of outputs in drug development with a view to obtaining a better understanding of the public private mix in cancer research activity. Apart from early phase clinical trials where we know publications (outputs) do not reflect activity, the research presented in this report uses bibliometrics as a means of understanding current and past state of cancer drug development. The research uses major databases and constructs with key drug names to analyse the trends in output and impact by country, institution and even researcher. It examines how models of partnership (institution-to-institution and institution-industry) have changed and also at the patterns of funders over time. Such changes can then be reviewed in the context of the impact of national policies.

Third, to investigate the cumulative life-time funding of specific cancer drugs. The question of how and who funds cancer drug development can most effectively be answered by looking at the cumulative lifetime from inception/discovery (NME) to clinic. Taking a representative sample of current cancer drugs, the report looks at their funding histories from inception to market.

Fourth, to review the current public policy affecting cancer drug development. There is substantial literature on the generic process of drug development (essentially data documents) and specific policy issues (e.g. Intellectual Property) but few, which are either disease-specific or take a horizontal approach to the affect of policies (i.e. how different policies interact with each other in a cumulative manner). This report reviews five streams of current public policy, which affect cancer drug development both in Europe and the USA, notably (a) policies affecting public R&D investment in cancer research, particularly at Member State & Institutional (University-Hospital complex) level and differing polices around public-private ventures; (b) transnational investment polices focusing on funding by bodies such as the EU Commission compared to the US NCI; (c) regulatory policies, specifically the clinical trials directive; (d) tax and IPR policies and (e) the likely impact of drug reimbursement policies on the development of cancer drugs.

Finally, to propose polices to support further cancer drug R&D. This objective has been informed by the emerging evidence in this report as well as by key opinion leaders (senior clinicians) in cancer drug discovery and development with a view to proposing key public policy measures to support innovation in European cancer drug development.

Chapter 2 places cancer research in context by providing a historical background to cancer drug development; Chapter 3 presents the public and private trends in cancer drug research and development; Chapter 4 presents the results of the investigation into the cancer research activity in both the public and private sectors, whereas Chapter 5 builds on the senior clinician survey to propose policies to support cancer drug R&D. Chapter 6 debates the issues surrounding public policies affecting cancer drug development. Finally, Chapter 7 draws the main conclusions and considers the policy implications.

References

1. Jonsson B, Wilking N (2007) Annals Oncol 18(3):iii1-54 doi:10.1093/annonc/mdm095

2. American Cancer Society (2009) Cancer Facts and Figures

3. Kanavos P (2006) The rising burden of cancer in the developing world Annals Oncol 17(S8):viii16-23

4. World Health Organisation (2008) The Global Burden of Disease: 2004 update. WHO

5. Boyle P, Levin B (eds.) (2008) World Cancer Report 2008, Lyon: International Agency for Research on Cancer

6. World Health Organisation. Priority medicines for Europe and the world. WHO/EDM/PAR/2004.7.2004; http://whqlibdoc.who.int/hq/2004/

7. Brown M, Lipscomb J, Snyder C (2001) The burden of illness of cancer: economic cost and quality of life Annu Rev Public Health 22:91113 PMID: 11274513

8. Disease-specific Estimates of Direct and Indirect Costs of Illness and NIH Support. National Institutes of Health 2000

9. Goodman LS, Wintrobe MM, Dameshek W et al (1946) Nitrogen mustard therapy. Use of methyl bis (B-chloroethyl) amine hydrochloride and tris (B-chloroethyl) amine hydrochloride for Hodgkin's disease lymphosarcoma, leukemia, certain allied and miscellaneous disorders JAMA 132:126132

10. Farber S, Diamond LK, Mercer RD et al (1948) Temporary remissions in acute leukemia in children produced by folic acid antagonist, 4-aminopteroyl-glutamic acid (aminopterin) NEJM 238:787793 PMID: 18860765 doi:10.1056/NEJM194806032382301

11. DiMasi JA, Hansen RW, Grabowski HG (2003) The price of innovation: new estimates of drug development costs J Health Econ 22(2):151185 PMID: 12606142 doi:10.1016/S0167-6296(02)00126-1

12. DiMasi JA et al (1995) R&D costs for new drugs by therapeutic category: a study of the US pharmaceutical industry PharmacoEconomics 7(2):152-69 PMID: 10155302 doi:10.2165/00019053-199507020-00007

13. Adams CP, Brantner VV (2006) Estimating the cost of new drug development: is it really 802 million dollars? Health Aff (Millwood) 25(2):420428 PMID: 16522582 doi:10.1377/hlthaff.25.2.420

14. PhRMA, 2007 Drug Discovery and Development: Understanding the R&D process Pharmaceutical Research and Manufacturers of America, 2007

15. Lengauer C, Diaz LA, Saha S (2005) Cancer drug discovery through collaboration Nature Reviews, Drug Discovery 4:375-380 doi:10.1038/nrd1722

16. Clinton P (2007) R&D Innovation: An Answer to Cancer (interview of Joseph Bolen Millennium CSO and chairman of the 12th Annual World Congress on Drug Discovery and Development of Innovative Therapeutics in 2007) http://pharmexec.findpharma.com/pharmexec/PE+Features/RampD-Innov ation-An- Answer-to-Cancer/ArticleStandard/Article/detail/463103

17. Bardelli A. et al (2003) Mutational analysis of the tyrosine kinome in collateral cancers Science 300: 949 PMID: 12738854 doi:10.1126/science.1082596

18. Lynch TJ et al (2004) Activating mutations in the epidermal growth factor receptor underlying responsiveness of non-small-cell lung cancer to gefitinib NEJM 350:2129-2132 PMID: 15118073 doi:10.1056/NEJMoa040938

19. Paez JG, et al (2004) EGFR mutations in lung cancer: correlation with clinical response to gefitinib therapy Science 300:1497-1500

20. Booth B, Glassman R, Ma P (2003) Oncology's trials. Nature Reviews Drug Discovery 2:609-610 doi:10.1038/nrd1158

21. CMR International 2009 R&D compendium, Epsom, UK

22. Russell M, Gjaja M, Lawyer P (2008) The future of Pharma: adjusting the Pharma R&D Model Boston Consulting Group, April 2008 in the PAREXEL's Bio/Pharmaceutical R&D Statistical Sourcebook 2008/2009; 27-28

2. THE HISTORY AND SCIENCE OF CANCER DRUG DEVELOPMENT

This chapter provides a brief journey through the major historical developments in European cancer research and a discussion of the key areas of current cancer drug discovery new chemical entities and biologicals (immunotherapy).

2.1. An European History of Cancer Research

Europe's seminal contributions to the milestones of cancer research are many and can be traced back to 1889 when Dr. Stephen Paget, a London Surgeon, developed the 'seed and soil' hypothesis of metastasis.

The prevailing view at that time was that cancer cells spread through the blood or lymph and could take up residence in any tissue. If this had been true, metastases would have shown a random distribution to other organs. Paget thought otherwise. 'When a plant goes to seed, its seeds are carried in all directions. But they can only live and grow if they fall on congenial soil...' he wrote (one of the wonderful things about research in this era was the use of the natural world as an unlimited source of metaphor and analogy, sadly lost in today's prosaic research culture). Paget examined nearly a thousand cases and found that specific tumours metastasised consistently to particular organs.

Although this view was challenged by James Ewing, who gave his name to a type of soft tissue cancer, or sarcoma, claiming instead that metastases settled in the first organ they reached as they spread through the vasculature, Paget was to be proved correct in 1980 by Isaiah Fidler and Ian Hart working at the MD Anderson Cancer Center at the University of Texas.

Almost simultaneously with Paget in 1890, just a few years after the discovery of chromosomes, David P. Hansemann, a pathologist-in-training with Rudolph Virchow in Berlin, produced a theory of the pathogenesis of cancer. This included a key concept that the first change that occurs in cancer is an alteration of the hereditary material of a normal cell at the site where the cancerous process begins. In the process of linking cancer to chromosomal material, Hansemann coined the terms 'anaplasia'd and 'dedifferentiation'.e These terms have remained the basis of descriptive terms concerning the microscopic appearances of tumours ever since.

The great German tradition in cancer research continued with people such as Theodor Heinrich Boveri (1862-1915), a German zoologist. In his work with sea urchins, Boveri showed that it was necessary to have all chromosomes present in order for proper embryonic development to take place. His other discovery was the centrosome (1888), which he described as the special organ of cell division. He also reasoned that cancer begins with a single cell, in which the make-up of the chromosomes is scrambled, causing the cells to divide uncontrollably.

It was Paul Ehrlich who was to make the link between the immune system and cancer, suggesting that for the latter to survive the former had to be suppressed. Paul Ehrlich, who won the 1908 Nobel Prize in physiology and medicine, also predicted autoimmunity calling it 'horror autotoxicus'. He coined the term 'chemotherapy' and popularised the concept of a 'magic bullet'.

However, one should not view Europe's role in turning back the tide of cancer as an isolated one. Then, as now, research was a complex dance over distance and time. Europe's great contributions are intimately intermingled with those in other countries and continents.

Europe has also laid the foundations of many other domains of cancer research. The most important discovery in the history of cancer epidemiology was the carcinogenic effect of tobacco. The pivotal studies begun by Sir Austin Bradford Hill and Sir Richard Doll, and later with Sir Richard Peto, were to provide the springboard for five decades of research on both sides of the Atlantic.

In surgery there have been many seminal contributions by the European cancer research community. Umberto Veronesi, an Italian Surgeon and Oncologist, was the founder of breast-conserving surgery, inventing the technique of quadrantectomy, which challenged the idea, then dominant among surgeons, that cancers could be treated only with aggressive surgery.

Europe has been at the forefront of treating bowel cancer through surgical advances from 1908 when Ernst Miles first described the abdominoperineal resection, to the first description of total mesorectal excision by Bill Heald and colleagues in 1982. This gave rise to clinical trials in Scandinavian countries that were to change global clinical practice.

The recent breakthrough in controlling cervical cancer through the use of a vaccine directed against certain types of human papilloma virus (HPV) rests on the work of Harald zur Hausen, who was first to show that the papilloma virus was the most significant cause of this cancer. In turn, that work owed much to the groundbreaking research begun in 1910 by Peyton Rous who first discovered tumour viruses.

Research into the molecular and cellular biology of cancer has provided remarkable insights into the molecular basis of cancer, such as disordered cell proliferation, disturbed differentiation and altered cell survival, and disruption of normal tissue, invasion and metastasis. New discoveries in the molecular oncology of tumours in the last few decades have led to major improvements in cancer therapy. In the middle of the 20th century an improved molecular classification of malignant lymphomas paved the way for individualised therapy in cancer. The treatment based on these molecular classifications resulted in higher response rates and improved survival of patients with malignant lymphomas. One of the most prominent scientists involved in this molecular pathology research and one of the authors of the new Kiel classification of lymphomas was Karl Lennert, a German Pathologist.

The field of breast cancer, the most frequent cancer in women, has seen many new developments based on the European research shared with other countries. Pivotal experiments performed in the late 1950s and early 1960s, primarily in the laboratories of Gerald Mueller and Elwood Jensen in Germany and the USA, set the stage for the development of hormonal therapy in hormone-responsive breast cancer. Acknowledgement of hormone receptors as one of the major biological determinants of breast cancer was actually one of the first discoveries that enabled the most effective strategies in the treatment of cancer, which is targeted therapy. Hormonal therapy with tamoxifen was the first individualised, targeted therapy in the history of cancer therapy.

Nowadays, breast cancer can be divided into hormone-receptor-positive and hormonereceptor-negative tumours, with treatment being substantially different in these two distinct diseases. Based on the largest meta-analysis in cancer care, undertaken at Oxford by Sir Richard Peto and his co-workers in the Early Breast Cancer Trialists' Collaborative Group, a vast amount of knowledge on the best possible adjuvant systemic therapy in hormonepositive and hormone-negative breast cancer was accumulated. Their work confirmed that adjuvant chemotherapy reduced the rate of recurrence by 33% and the rate of breast cancer death by 17%, saving thousands of lives of women with breast cancer. The same was true for hormonal therapy in hormone-responsive breast cancer, in which adjuvant hormonal therapy with tamoxifen was found to reduce the rate of recurrence by 41% and the rate of breast cancer death by 34%, according to the data from the meta-analysis. Adjuvant systemic therapy, in addition to surgery, radiotherapy and screening programmes has been responsible for major declines in breast cancer mortality during the last two decades in the USA and Europe.

In 1971 when Richard Nixon proclaimed war on cancer 'a quick and decisive victory was predicted'.f However, despite the expenditure of billions of pounds and some real improvements in survival, especially in paediatric oncology, the morbidity and mortality associated with cancer remains high. Although the majority of cancer treatments are due to the surgical scalpel and radiotherapy it is advances in chemotherapy that hold the key to controlling and ultimately defeating cancer [1].

2.2. New Paradigms in Chemotherapy

The problem with conventional cytotoxic chemotherapy is rather obvious the therapeutic window is narrow and only partially effective. This leads to poor efficacy and tolerability, as well as the development of serious adverse reactions. Combination chemotherapy has been the intellectual development to address the former issue but at the expense of tolerability and toxicity. Chemotherapy that targets all abnormal cells whilst sparing normal tissues has seemed a distant prospect, but now the ability to probe the most intimate details of the cell through the application of genomic and proteomic technologies has the potential to fulfil this dream. At the heart of this is the vision that new chemotherapy can be developed to selectively target cancer [2]. The new paradigm couples technology, such as robotic high-throughput screening, combinatorial chemistry, structural biology and molecular modelling with new insights into the pathophysiology of cancer and therefore new therapeutic strategies, for example the role of new blood vessel formation for metastatic disease and development of anti-vascular and angiogenic agents [3]. There have been encouraging signs that this approach may work. A signal transduction inhibitor (Imatinib) that selectively targets the abnormal BCR-abl fusion protein (Philadelphia chromosome product) that drives Chronic Myeloid Leukaemia, has demonstrated remarkable efficacy, with little toxicity. The more that we learn about cancer biology the more approaches present themselves growth factor receptors, immune system modulation, cellular matrix, targeting of proliferation, migration and survival (apoptosis).

Natural product drugs that continue to play the dominant role in armoury of therapeutic options are also complimenting designer chemotherapy. Some of today's most clinically successful chemotherapies are derived from nature paclitaxel, vincristine, vinorelbine and analogs of camptothecin [4]. In fact, in the last 50 years only the rational structural design of 5-fluorouracil by Heidelberger has bucked the serendipity trend [5]. However, since the early 1990s this has changed dramatically with agents designed against rational targets cetuximab, bevacizumab, to name but two. The hope is that efficacy can be enhanced by combining these cytotoxics with the newer targeted agents. Furthermore, it has become apparent that individual responses efficacy and toxicity are in part determined by genetically determined factors. This has led to the emerging disciplines of pharmacogenomics and pharmacogenetics that, using emerging technologies such as single-nucleotide polymorphism typing, aim to tailor chemotherapy [6]. However, this is still a very nascent field that has yet to be fully validated.

The past 10 years has seen a paradigm shift in cancer drug development away from direct acting anti-cancer agents, be they antibodies, novel signal transduction inhibitors or conventional cytotoxics, which have been at the heart of chemotherapeutic strategies for more than 40 years. Conventional wisdom underpinned by solid evidence from randomised controlled trials dictates that direct tumour cytotoxicity is an effective strategy. However, in spite of success in curing a variety of cancers from paediatric to adult with modest gains in the adjuvant/neoadjuvant setting for a subset of patients as well as much needed palliation in other settings, the fact remains that new strategies, or combinations of strategies, are needed to deal with advanced, metastatic disease.

2.3. Attacking Cancer

Cancer cells, despite their escape from normal intra- and extra-cellular controls, are still highly dependent on interactions between their cell surface receptors and other cells (cell-to-cell adhesion), growth factors, cytokines, hormones and elements of the extracellular matrix. Furthermore, they must continue to evade immune detection and, beyond a certain size, need to stimulate new blood vessel growth angiogenesis. Targeting the world around the cancer cell is role of indirect acting anti-cancer agents.

Remarkably, targeting the tumour blood vessels as a therapeutic option was first suggested some 20 years ago by Juliana Denekamp and colleagues at the Gray Laboratory writing in the British Journal of Cancer. Aided by quantum leaps in technological development, particularly in real-time imaging of vascular flow and function through such techniques as dynamic contrast-enhanced magnetic resonance imaging (DCE-MRI), positron emission tomography (PET) and laser doppler flowmetry, targeting angiogenesis has been a leading research area. Two broad fronts have been engaged. One approach targets the intracellular protein tubulin and has the dual attraction of acting as a mitotic poison for tumour cells and an antivascular agent. Various novel candidates are in development, and early phase clinical development has been completed for combretastatin A4 phosphate [7].

The other front has been to exploit the differential expression of endothelial surface proteins. Various approaches are being trailed, including immunotoxins and targeted gene therapy. Multiple mode-of-action agentsg are also being examined. One of the most promising agents to demonstrate exceptional antivascular properties is a low-molecular weight compound termed DMXAA, derived from the non-steriodal anti-inflammatory flavone acetic acid [8]. This is currently the focus of a number of studies. More advanced and well-validated approaches have been through the targeting of blood vessel growth factor receptors utilising recombinant humanised monoclonal antibodies or small molecule inhibitors.h

The dual finding that many solid cancers not only have deregulated signalling pathways but also trigger new blood vessel formation by the cancers suggests a need for combination direct/indirect strategy. One such new molecular entity that takes this approach is a pyrrolo-pyrimidine derivative (AEE788), and dual inhibitor of both these pathways, which has reported activity in pre-clinical models, particularly head and neck squamous cell carcinoma, a tumour notoriously resistant to treatment.i Although exciting science, it remains to be seen whether these '2-in-1' agents are better than combining two different classes of agents, for example antibody against VEGF and tyrosine kinase inhibitor for EGFR or vice-versa. Interestingly, it is not just novel compounds with dual mechanisms-of-action (indirect & direct acting) that are attracting interest. Thalidomide appears to exert its anti-cancer activity through numerous actions via growth factors tumour blood vessels and cytokine modulation.

Broadly speaking, immuno modulationj has not proved itself yet to be the success that William Coley's seminal work in the 19th century suggested it could be. Coley, a New York Surgeon demonstrated clinical remission in advanced cancer patients treated with an mixture of inactivated S. pyogens and Serratia marcesens, work that was not reported until after his death by the careful scholarship of his daughter Helen Nauts [9]. Modulation of innate and adaptive immunity has been a complex and difficult task. One approach has been to target cytokinesk. A number of these molecules with a variety of immuno-modulating properties are currently being assessed in clinical trials with some (e.g. IL-2, IFN-a/g, TNF-a) at late stage development [10]. Many cytokines have also been shown to be important survival factors for various tumours, for example IL-6 for breast and prostate cancers. IL-6 has also been shown to enhance pancreatic cancer survival, cell migration and proliferation in the presence of HER2 inhibition. Such insights are vital for guiding potential combination therapies, in this case for instance this work suggests that without IL-6 inhibition any HER2 targeted therapy, for example trastuzumab (Herceptin) would be at the very best ineffective. A dual indirect/direct acting strategy is also being employed by the generation of antibodies fused to cytokines [11]. Recombinant cytokines are also being combined with other indirect acting immunological therapies including cancer vaccines [12].

Numerous approaches have been utilised in developing cancer vaccines from tumour antigens to naked DNA or RNA [13]. Despite early disappointment that vaccines failed to demonstrate clinical efficacy, promising immunostimulation has been achieved, and new approaches such as DNA vaccines, particularly if used in combination therapies, have the most realistic prospect of success. Likewise, promising early results with dendritic cell vaccines (DC's are essential for the induction of adaptive immunity) have not been replicated in larger trials. Part of the problem may lie in DCs' interactions with growth factors [14]. Either such inhibitory networks need to be circumvented or inhibited by targeting the relevant growth factor.

Anti-cancer agents targeting the tumour environment are essential for a number of reasons, namely the ability of cell-cell and of cell-matrix interactions to:

- enable immune evasion;

- act as proliferation and survival signals;

- enhance migration (metastasis);

- enable tumours to acquire multi-drug resistance (MDR).

Part of the problem with targeting the tumour environment has been the difficulty in identifying key, rate-limiting factors, and therefore potential targets that support cancer cell proliferation and survival. Even when such factors are identified, there remains the difficulty of tumour selectivity in any therapy designed against a component of the normal extracellular matrix the tissue architecture in which normal cells function. However, there are encouraging signs of progress in identifying novel targets in the extracellular matrix that surrounds cancer cells and in further determination of their pathophysiological role. Spangaletti and colleagues have recently demonstrated the importance of a basement membrane organising protein, Sparc, secreted from stromal cells, for the immune protection and development of new blood vessel formation for breast cancer cells [15].

The observation that the extracellular matrix surrounding tumour cells can protect against inhibition with new chemical entities targeting signalling pathways suggests, again, a need for dual direct/indirect anti-cancer therapies. The multi-factorial nature of drug resistance will also require combination therapies that can target a variety of environmental factors from extracellular matrix proteins to key growth factors and cytokines [16].

Development of novel screening methodologies, such as target-related affinity profiling (TRAP), have also led to further developments towards first-in-man trials, in this case the identification of novel small molecule lead compounds against targets implicated in promoting tumour proliferation and survival.l Another major area of research has been in preventing cancer cell migration/invasion through the use of matrix metalloproteinase inhibitors such as marimastat, and the Bayer and Bristol-Mayers-Squibb compounds BAY12- 9566 and BMS275291. The universally negative results to these compounds to date indicate a deficiency in our knowledge about the actual pathophysiological of migration/invasion. More research is needed to understand the complex interplay between tissue architecture, secreted growth factors, non-cancerous and cancerous cells if rationale combination strategies are to be formulated.

Will these strategies be a solution? By themselves it is unlikely, but in combination (e.g. targeting various in-direct domains angiogenesis, growth factors, etc. or with direct acting agents) there is real potential. Substantial difficulties remain resistance secondary to plasticity in the various signalling pathways, the potential for significant side-effects, insufficiently 'potent' anti-cancer activity and the difficulty of designing agents with sufficient selectivity, as well as the perennial problem of delivery.

In his concluding remarks to the 12th Annual Pezcoller Symposium, Ed Harlow commented that it would be important to utilise complex read outs to spread information on how different actions interact in a cell as well as the combined expertise of different laboratories; this was just to address single-cancer cell signalling pathways [17]. In fact, integrating anti-cancer strategies is an order of magnitude greater in complexity for dissecting biological crosstalk and key interactions compared to the level of single cancer cell and its signalling pathways. There remains much to understand mechanistically about tumour-environment interactions, but the goal must be to try out these combinations in imaginative and perhaps even in empirical manners. There is now good evidence that tumour responses are a group phenomenon rather than the summed responses of individual cells to injury. Thus the classic description of the bystander effect in radiation oncology may be relevant to chemotherapeutic strategies where indirect and direct acting anti-cancer agents are combined to substantially enlarge the direct injury to the tumour cells.

How is this likely to be best achieved? Clearly, the parallel investigation of cancer biology and selection of new indirect/direct-acting combination strategies requires integrated clinical studies that maximise pharmacological, cellular biological and molecular pathological information capture. The ability to take time and explore unusual or counter-intuitive avenues will be essential. Strong academic centres supported by high-quality organisational structures funding specific projects underpinned by long-term programmatic funding are the ideal environment to investigate these complex areas [18]. This strength has already led to substantial biotech spin-offs and provides a rich environment within which public-private partnerships can work to tackle these therapeutic challenges.

2.4. Biologicals for Cancer Therapy

The last decade has seen a surge of research and development focused on biologicals, which must be considered now as being one of the hottest areas for anti-cancer drug discovery.